Homeowners Insurance in and around Lombard

Protect what's important from catastrophe.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

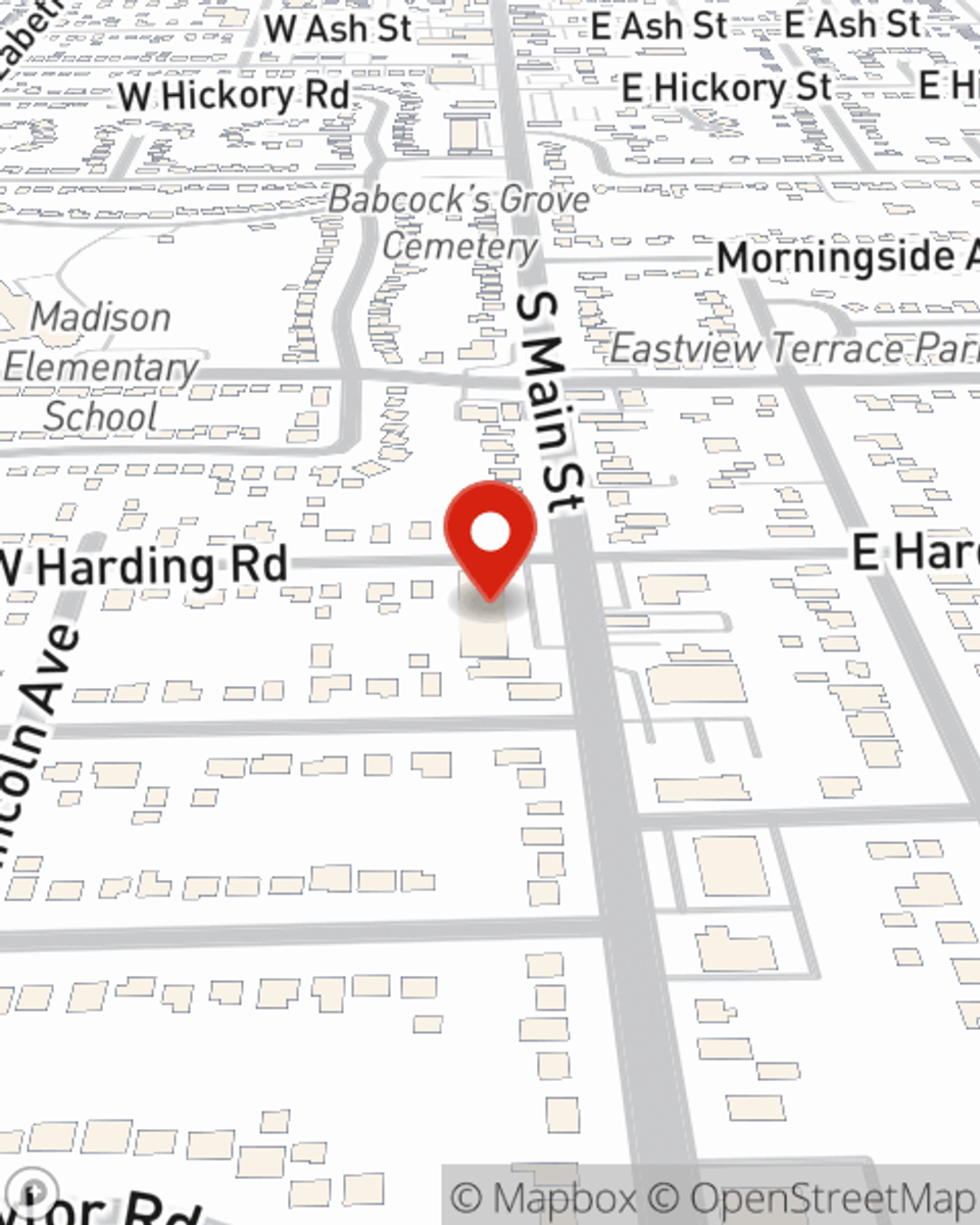

- Lombard, IL

- Illinois

- Dupage County

- Lake County, IL

- Lindenhurst, IL

- Lake Villa, IL

- Antioch, IL

- Glen Ellyn, IL

- Villa Park, IL

- Oakbrook Terrace, IL

- Oak Brook, IL

- Downers Grove, IL

- Westmont, IL

- Gurnee, IL

- Hinsdale, IL

- Burr Ridge, IL

- Lisle, IL

- Wheaton, IL

- Naperville, IL

- Woodridge, IL

- Wisconsin

- Indiana

- Grayslake, IL

- Crystal Lake, IL

There’s No Place Like Home

It's so good to be home, especially when your home is covered by State Farm. You never have to be anxious about the accidental with this outstanding insurance.

Protect what's important from catastrophe.

Apply for homeowners insurance with State Farm

Agent Julie Guenther, At Your Service

Excellent coverage like this is why Lombard homeowners choose State Farm insurance. State Farm Agent Julie Guenther can offer coverage options for the level of coverage you have in mind. If troubles like drain backups, service line repair or sewer backups find you, Agent Julie Guenther can be there to help you file your claim.

As your good neighbor, State Farm agent Julie Guenther is happy to help you with getting started on a homeowners insurance policy. Contact today!

Have More Questions About Homeowners Insurance?

Call Julie at (630) 268-1818 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Julie Guenther

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.